GBPUSD maintains a positive outlook ahead of key US data releases.

In early Thursday trading, the Cable is testing above the 1.2800 level, suggesting that the recent shallow correction from its recent 8-month high of 1.2893 may have run its course

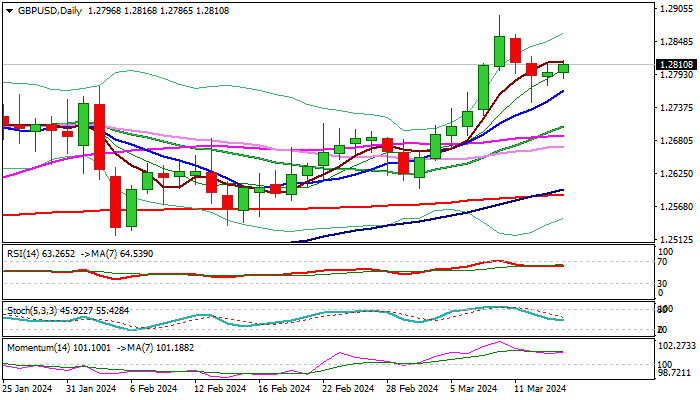

The two-day pullback found support around the rising 10-day moving average, with a notable rejection of further downside on Wednesday. This indicates strong buying interest, affirming the presence of bullish sentiment in the market

On the daily chart, the technical picture remains bullish, with positive momentum and the Tenkan and Kijun-sen lines in a bullish configuration, diverging from each other. A daily close above 1.2800 (the 38.2% Fibonacci retracement level of the correction from 1.2893 to 1.2745) is seen as the minimum requirement to sustain upward bias in the near term

The British pound gained momentum following the digestion of US inflation data and growing expectations for a rate cut in June, which weighed on the US dollar once again