Crude Prices Decline Amid Rising Supply and Escalating Trade War

WTI Crude Extends Decline, Hits Three-Month Low

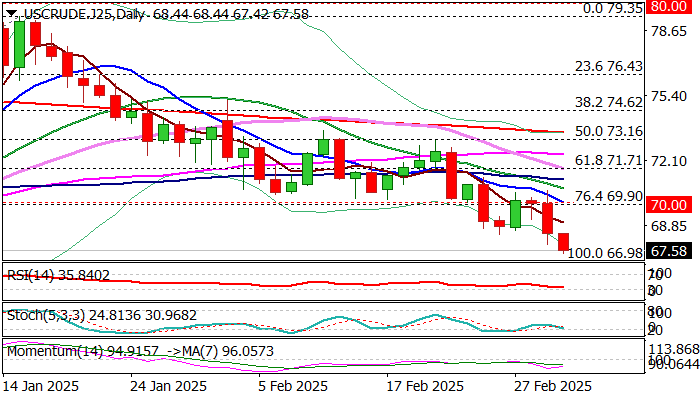

WTI oil continued its sharp slide on Tuesday, extending losses from Monday’s lower top at $70.58 and reaching its weakest level in nearly three months.

Several factors are weighing on oil sentiment, including OPEC+’s decision to proceed with planned production increases, heightened uncertainty over the escalating trade war, and the halt of US military aid to Ukraine.

Markets anticipate that a slowing global economy, exacerbated by trade tensions, will significantly impact oil demand, while rising supply is expected to put further pressure on prices.

From a technical perspective, the bearish outlook remains intact after WTI broke through key support levels at $70/$69.90 (psychological barrier and 76.4% Fibonacci retracement of the $66.98–$79.35 rally). Multiple failed recovery attempts at this zone reinforced downside momentum, leading to renewed selling pressure.

Any upticks due to profit-taking are likely to be limited, with strong resistance at $69.70/$70, reinforced by the falling 10-day moving average, keeping the broader bearish structure intact and offering fresh selling opportunities.

Key Levels:

-

Resistance: 68.37, 69.00, 70.00, 70.58

-

Support: 67.42, 66.98, 66.54, 65.26