Bullish Momentum in USDJPY Remains Strong Post Consolidation

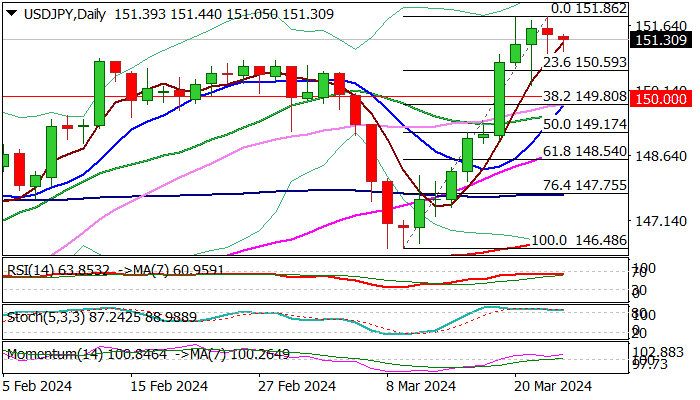

Following a robust rally over the past couple of weeks, the USDJPY pair is currently undergoing a period of consolidation just below critical resistance levels at 150.90/94, corresponding to the highs of 2023/22.

The surge in USDJPY can be attributed to the considerable interest rate differential between the United States and Japan. Despite the Bank of Japan’s recent rate hike, market sentiment suggests a lack of enthusiasm for aggressive policy tightening measures from the central bank.

However, investors are treading cautiously in light of recent warnings from Japanese officials regarding the perceived weakness of the yen. This cautious approach leaves the possibility of intervention by authorities on the table.

Analyzing the technical indicators on the daily chart reveals a firmly bullish outlook, signaling potential for further upward movement. The current consolidation phase serves as a corrective measure to address overbought conditions, paving the way for renewed upward momentum.